Semicon China 2025: Boundless Collaboration, One Silicon Future

Original Articles by SemiVision Research

Semicon China 2025: Boundless Collaboration, One Silicon Future

Since its debut in Shanghai in 1988, SEMICON China has become one of the most prominent events in China’s semiconductor industry, featuring major equipment and material manufacturers in the global semiconductor manufacturing sector. SEMICON China has witnessed the robust growth and accelerated development of China’s semiconductor manufacturing industry, and it will undoubtedly contribute to the future strength and growth of China’s semiconductor manufacturing industry.

Analysis of the Current Status of China’s Semiconductor Industry Development

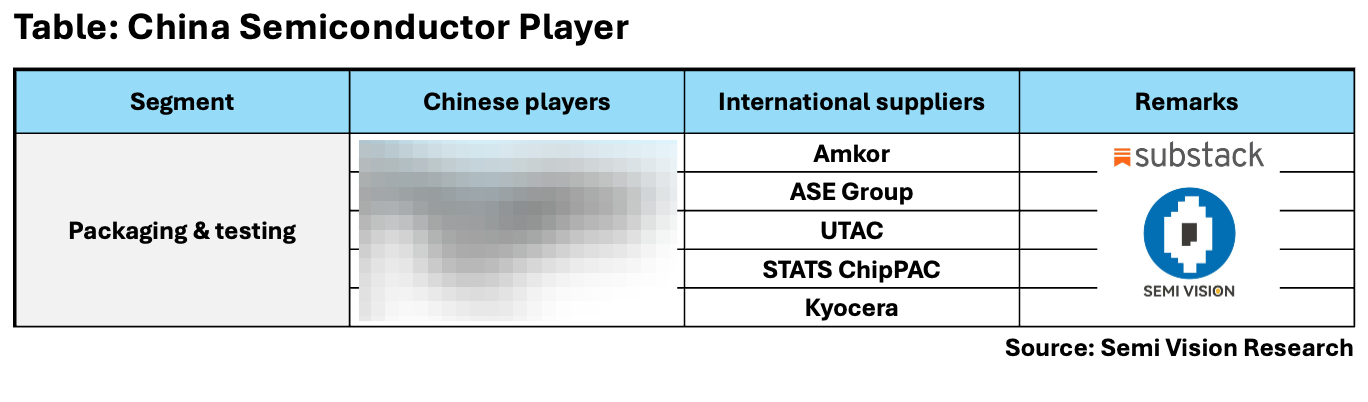

In recent years, China’s semiconductor industry has experienced rapid development against the backdrop of global industry chain restructuring, geopolitical pressures, and the domestic drive for technological self-reliance. Significant progress has been made in wafer manufacturing, chip design, packaging and testing, as well as equipment and materials. This article will analyze the current status and challenges of China’s semiconductor industry in key areas such as wafer manufacturing, chip design, packaging and testing, semiconductor equipment, and materials.

Wafer Manufacturing: Capacity Expansion, but Limited Advanced Processes

China’s wafer manufacturing industry has seen rapid growth, driven by policy support, financial investment, and domestic demand. Key players include SMIC, Huahong Group, Yangtze Memory Technologies (YMTC), and Hefei Changxin(CXMT), which have made strides in logic chips and memory chips.

Development Status and Opportunities of Yangtze Memory Technologies (YMTC) and Changxin (CXMT)

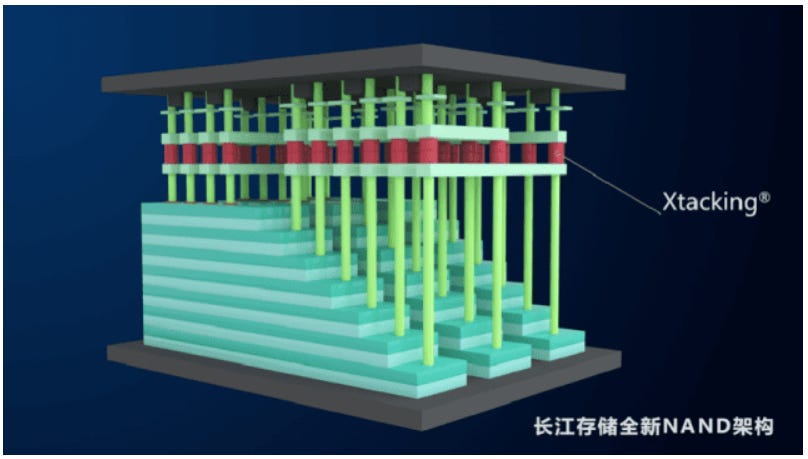

Yangtze Memory Technologies Co., Ltd. (YMTC) and Changxin Memory Technologies, Inc. (CXMT) are two key players in China’s semiconductor memory industry. YMTC focuses on NAND flash, while CXMT specializes in DRAM. Both have made significant progress in technology and market expansion, positioning themselves as strategic forces in China’s quest for semiconductor self-sufficiency.

YMTC – Yangtze Memory Technologies

Technology Progress:

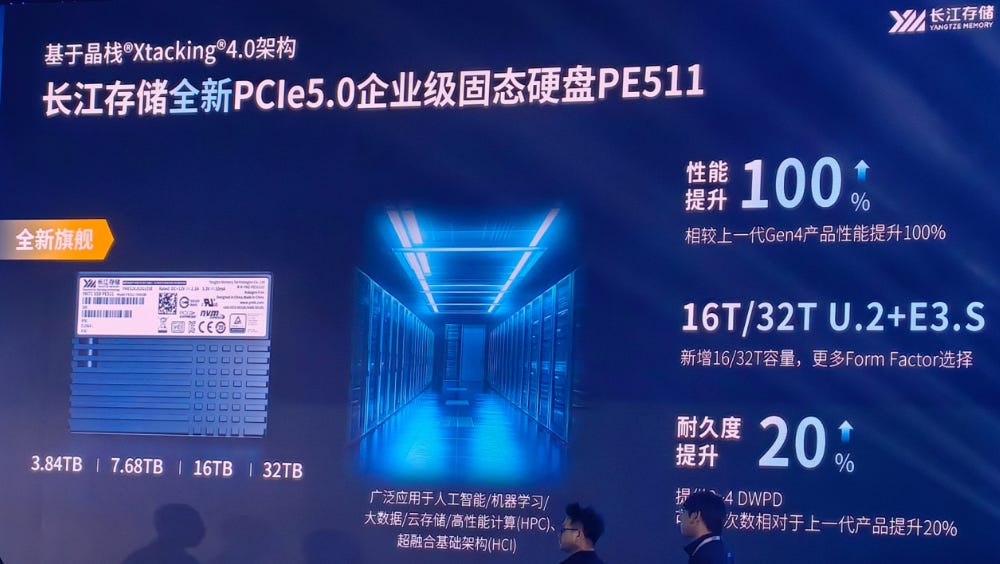

March 2025, YMTC announced the launch of PCIe 5.0 solid-state drives (SSDs) based on its Xtacking 4.0 architecture at the Flash Memory Summit. These SSDs incorporate various technologies and specifications, including PCIe 4.0, PCIe 5.0, TLC NAND, and QLC NAND.

The YMTC PCIe 5.0 SSD PC550 uses TLC NAND flash and is available in 512GB, 1TB, and 2TB capacities. It features a single-sided design, enhancing compatibility and making it suitable for a wide range of PCs and laptops.

The YMTC PC450 is also based on TLC NAND, but supports the PCIe 4.0 interface. It is available in the same 512GB, 1TB, and 2TB versions. As a more mature solution, it is expected to offer more competitive pricing.

Market and Shipments:

Despite being impacted by U.S. export controls, YMTC completed a major round of funding in October 2023. The company is actively developing domestic replacements for restricted components and manufacturing tools.

International Competitiveness & Export Restrictions:

In December 2022, YMTC was added to the U.S. Entity List, limiting access to American technologies and equipment. This has accelerated YMTC’s localization efforts to reduce reliance on U.S. suppliers.

Partnerships & Investment:

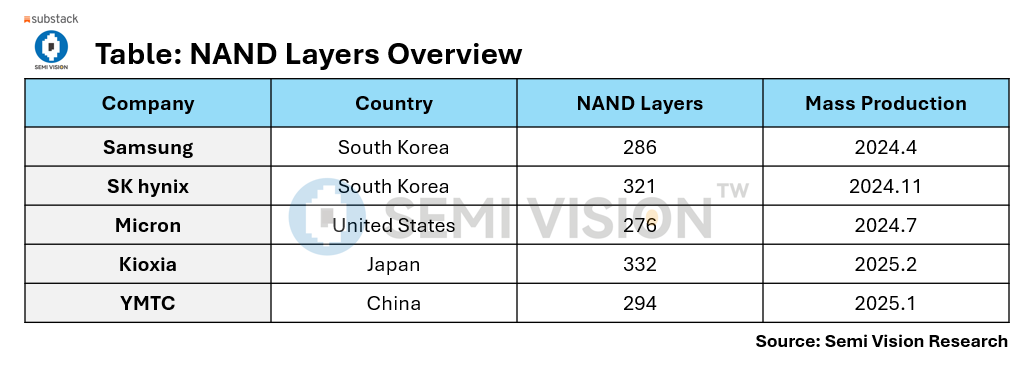

In March 2023, China’s National IC Industry Investment Fund injected an additional $1.9 billion into YMTC, signaling strong government support for its continued development. NAND flash, a non-volatile memory chip that stores data without requiring power, is largely controlled by South Korean giants Samsung and SK Hynix, which together hold over 50% of the global market. According to TrendForce, Samsung leads the industry with a 35.2% market share as of Q3 2024, followed by SK Hynix at 20.6%, Japan’s Kioxia at 15.1%, and U.S.-based Micron at 14.2%. In terms of technology, Samsung currently manufactures 286-layer NAND chips, while SK Hynix has advanced to 321 layers. Although China's YMTC holds a smaller portion of the market, it has accelerated its production of 294-layer NAND, quickly narrowing the technological gap with its South Korean competitors.

Application Opportunities:

YMTC’s high-layer NAND flash has potential applications in AI, data centers, and high-performance computing, contributing to China’s broader push for technological independence in critical areas.

CXMT – Changxin Memory Technologies

Technology Progress:

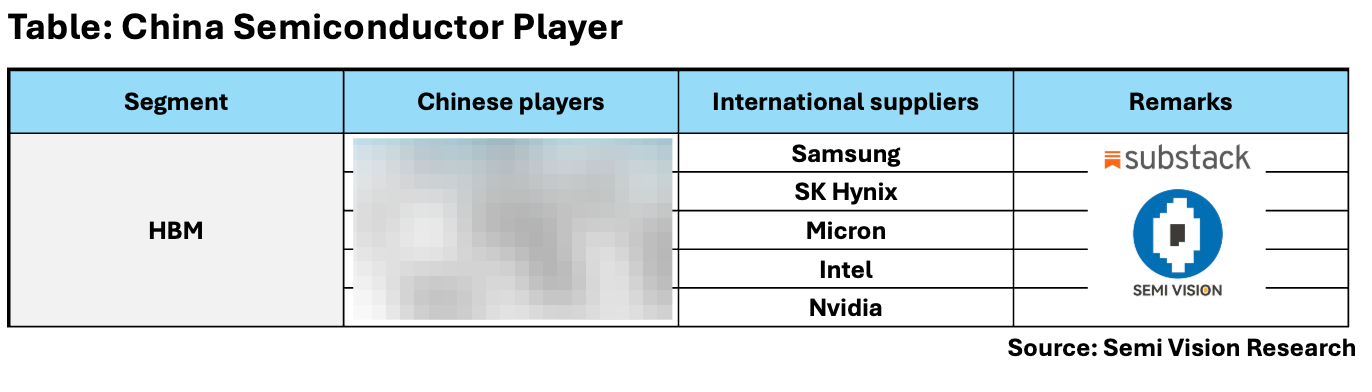

As of 2024, CXMT has achieved mass production of DDR5 DRAM and is planning a new fab in eastern Shanghai to produce HBM2, though the product lags behind cutting-edge international competitors.

Market and Shipments:

CXMT has grown its global DRAM market share from near zero in 2020 to about 5% in 2024, posing a rising challenge to South Korean memory giants.

International Competitiveness & Export Restrictions:

While CXMT still trails global leaders in technology and production efficiency, rapid improvements and strong government backing are boosting its international competitiveness.

Partnerships & Investment:

Backed by investors including Alibaba and support from Chinese government entities, CXMT is accelerating its R&D and expanding production capacity.

Application Opportunities:

With growing demand for high-bandwidth memory (HBM) in AI and HPC applications, CXMT’s planned entry into the HBM market could position it as a key player in the AI-era memory ecosystem.

YMTC and CXMT have made significant strides in R&D and market penetration, underscoring China’s rapid progress in the semiconductor memory sector. Despite facing geopolitical and technical hurdles, both companies are narrowing the gap with global competitors through innovation, investment, and state support. As AI, data centers, and high-performance computing continue to drive memory demand, YMTC and CXMT are well-positioned to play an increasingly important role in future memory markets.

China Semiconductor in Mature Processes (28nm and above)

Global Competitiveness: Currently, SMIC and Huahong have stable production capacity at 28nm and above, and hold a certain market share in 55nm, 40nm, and 28nm processes.

Analysis of China’s Mature Process Node Developments

1. Expansion of China’s Foundries and Market Impact

In recent years, China has made significant strides in mature process nodes (28nm and above) within the semiconductor sector. Major Chinese foundries such as SMIC (Semiconductor Manufacturing International Corporation) and Hua Hong Semiconductor have been actively expanding their capacity for mature nodes.

SMIC One-Stop Solution(Design Service IP —>Mask—>Manufacture—>Testing)

According to industry estimates, by the end of 2025, Chinese foundries are expected to account for over 25% of the global capacity among the top 10 mature-node foundries, with the majority of new capacity coming from 28/22nm nodes.

This aggressive expansion has disrupted global supply-demand balance in mature nodes, causing pricing pressure and impacting the profitability of global competitors such as UMC (Taiwan), PSMC (Taiwan), and GlobalFoundries (USA).

2. U.S. Investigation into China’s Mature Node Expansion

In December 2024, the Office of the United States Trade Representative (USTR) launched an investigation into China’s mature-node chip manufacturing practices. The investigation aims to determine whether China’s capacity expansion poses a threat to domestic and allied semiconductor producers.

Possible outcomes could include tariffs or export restrictions on Chinese-made chips, potentially further reshaping the global semiconductor supply chain.

3. Future Outlook

As Chinese foundries continue expanding their mature node capacity, global competition is expected to intensify. However, macroeconomic uncertainties and China’s own economic recovery pace remain key variables.

Additionally, visibility of mature-node orders remains limited to about one quarter, as end-device brands and upstream customers maintain cautious procurement behavior.

Forecasts suggest that in 2025, mature node capacity utilization among the top 10 global foundries may slightly improve to above 75%.

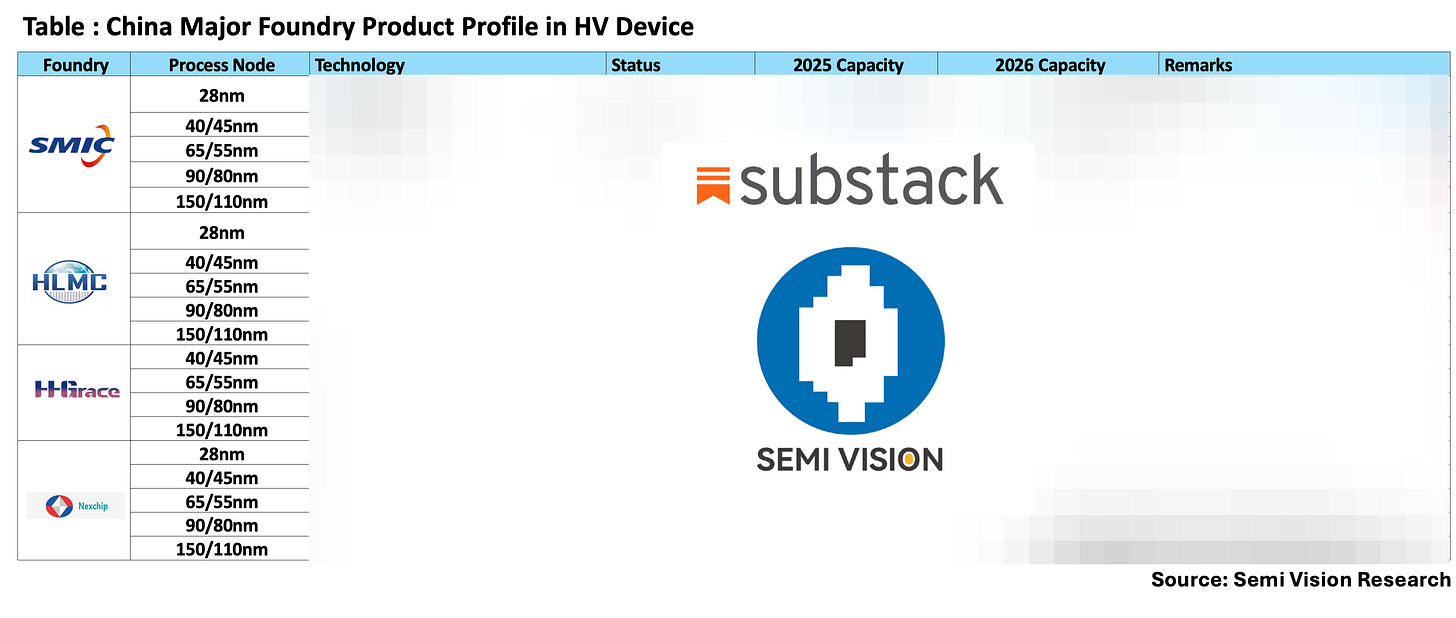

2025 Major Foundry Technology Node Summary

In China, the key wafer fabs to watch are SMIC and HHGrace, which currently possess advanced process capabilities. However, it is important to closely monitor yield and effective capacity as key indicators to evaluate their performance and overall success in the market. These factors will play a significant role in determining the long-term competitiveness of these fabs.

SemiVision Research has compiled the key process differences among major foundries, as shown in the table below.

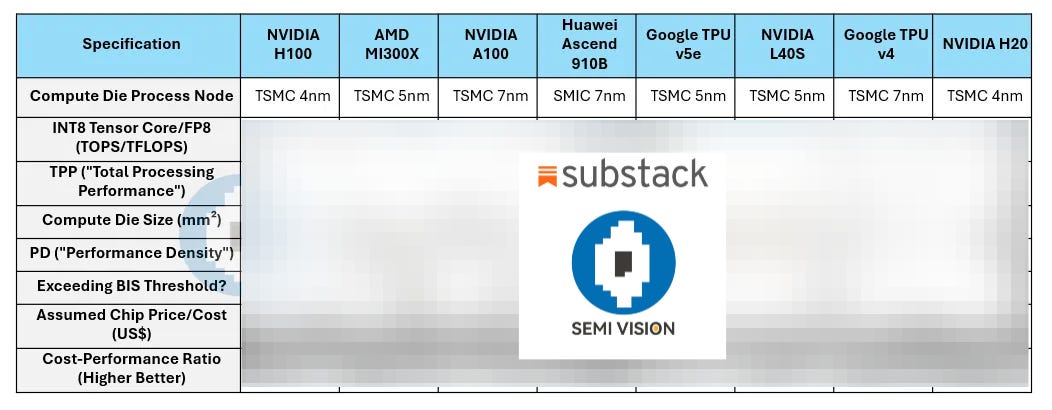

A comparative analysis of process differences among major foundries — TSMC, Samsung, and SMIC — is presented below.

For Piad Members, SemiVision Research will discuss following topics on

Summary Table: Comparative Analysis of TSMC, Samsung, and SMIC

SMIC’s Role in China’s Semiconductor Self-Sufficiency Drive

Localizing the Fab: SMIC’s Push for Domestic Equipment Independence

Strategic Partnerships and Global Expansion

SMIC’s Strategic Response to Geopolitical Risk

Scaling Up: SMIC and Huahong Lead China’s Fab Expansion Wave

Next-Gen Made in China: SMIC’s Progress in Advanced CMOS Nodes

Domestic Substitution Trend

Mapping China’s Memory Strategy: DRAM, NAND, and HBM in Focus

Challenging the Giants: China’s Rise in HBM and 3DIC Packaging

Towards Tech Sovereignty: China’s Push to Localize Equipment and Materials

Toward 5nm: China’s Ambitions and Barriers in Advanced Semiconductor Development

SemiVision Research will discuss following topics in future.

• China’s Quality Standards: The Persistent Gap with Global Suppliers and Recent Challenges in the Automotive Sector

• University-Industry Collaboration in China’s Semiconductor Industry: A Current Status Analysis

Navigating China’s Chip Industry: Special Topics and Insights

China Chips: A Strategic Analysis Series by SemiVision Research

A curated series of analytical articles exploring the strategies, challenges, and innovations driving China’s semiconductor industry.

Topic 1: The Path and Challenges of Technological Self-Sufficiency

• How is China advancing its own advanced process technologies (from 14nm to 7nm and 5nm) under U.S. restrictions on high-end equipment such as EUV lithography machines?

• What are the technical bottlenecks faced by SMIC and Hua Hong Semiconductor, and how are they using “curve-based” strategies (e.g., leveraging mature nodes to substitute advanced nodes)?

• What are the key obstacles in developing domestic EDA tools and production materials such as photoresists, high-purity silicon wafers, and fluorinated gases?

Topic 2: Development Strategy for Third-Generation Semiconductors

• What is China’s global strategy and capacity-building progress in materials like GaN (Gallium Nitride) and SiC (Silicon Carbide)?

• How are companies like BYD and Huawei driving the integration of third-generation semiconductors in automotive and power management applications?

• Does China have the potential to gain a leading position in the upcoming “power semiconductor war”?

Topic 3: The Multifaceted Impact of the U.S.–China Tech War on China’s Semiconductor Industry

• What are the long-term pressures imposed by U.S. export controls (e.g., Entity List, CHIPS Act) on China’s semiconductor supply chain?

• How does global supply chain reorganization under “de-risking” affect China, and what opportunities might it bring?

• How is China’s “import substitution” policy responding to technological blockades?

Topic 4: Reshaping the Semiconductor Supply Chain and the “De-Americanization” Process

• How is China building a fully “autonomous and controllable” semiconductor supply chain — from IC design to manufacturing to OSAT (packaging and testing)?

• What are the strategies and capabilities of companies like Phytium and Cambricon in AI chips and GPUs?

• How should we assess the technological gap with U.S. giants like NVIDIA and AMD, and identify potential breakthrough points?

Topic 5: The Dual-Engine Model of Capital and National Policy

• What are the key investment projects and outcomes of China’s National Integrated Circuit Fund (Big Fund) Phases I & II?

• Are local governments over-allocating resources or causing overcapacity in building semiconductor industrial parks?

• Is policy-driven funding creating an “investment bubble” in the semiconductor sector?

Topic 6: Foundry Capacity and the Rebalancing of the Global Semiconductor Market

• Will China’s aggressive expansion of mature node (28nm and above) wafer capacity reshape global supply and demand dynamics?

• What are the competitive and cooperative relationships with Taiwan, South Korea, and Southeast Asia?

• In the long term, can China gain dominance in global mature-node semiconductor manufacturing?

Topic 7: Localization Progress in Memory Chips

• What innovations has YMTC achieved in 3D NAND, and what challenges has it faced due to export restrictions?

• How is CXMT planning to catch up in the DRAM field, and what hurdles lie ahead?

• Can China’s domestic memory industry meet the demands of local markets, especially in smartphones and AI servers?

Topic 8: Integration of China’s Semiconductor Industry with Emerging Applications

• How are Chinese IC design firms (e.g., VeriSilicon, ASR) positioning themselves in IoT and automotive electronics?

• How are AI, edge computing, and smart manufacturing reshaping the requirements for local chip design capabilities?

• Can China establish a virtuous innovation cycle driven by application needs and hardware development?

Topic 9: Talent Competition and Technology Transfer

• What strategies is China using to attract high-end semiconductor talent from Taiwan, Korea, and Western countries — and what controversies does this raise?

• Are China’s universities and research institutes (e.g., Tsinghua’s Institute of Microelectronics) capable of supporting sustained innovation?

• Will China’s leadership further promote “military-civil fusion” to accelerate the commercialization of R&D outputs?

Topic 10: Global Cooperation and Confrontation under Geopolitical Tensions

• What are the prospects and political uncertainties surrounding China–EU and China–Japan semiconductor cooperation?

• Could China form an alternative technology system within a “De-Americanization Alliance”?

• Can BRICS countries establish a “parallel semiconductor ecosystem” to counterbalance Western dominance?