A Sudden Halt in US-China Trade: Who Stands to Lose More?

Original Article by SemiVision Research

In an era defined by globalization, the economic symbiosis between the United States and China has grown into one of the most influential bilateral trade relationships in modern history. A sudden and total cessation of trade between these two nations would not only trigger a seismic shift in their domestic economies but would also unleash ripple effects that could destabilize global markets and realign geopolitical alliances. With over $700 billion in annual goods and services exchanged, the cessation of this trade would be unprecedented in scale and complexity. In this expanded report, we examine—through five interrelated dimensions—how each country would be affected and which side stands to incur the greater cost.

1. Macroeconomic Impact: GDP Losses and Inflationary Pressures

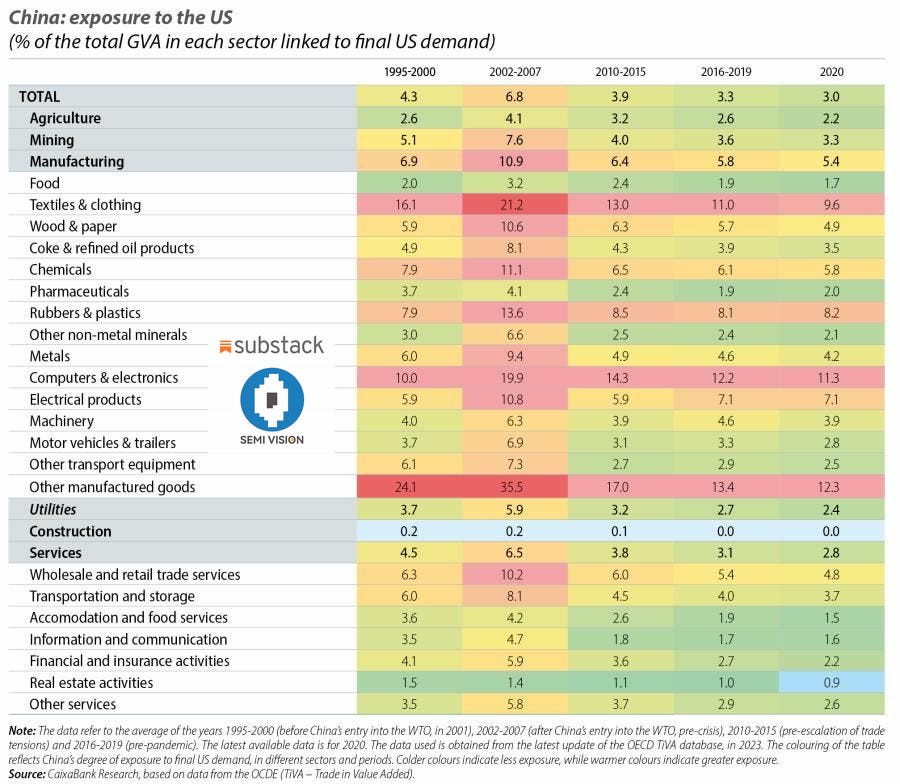

China’s economy, while increasingly diversified, remains significantly dependent on exports—especially to the United States. In 2023, Chinese exports to the US accounted for roughly 2.9% of the nation's GDP, down from nearly 4% a decade earlier. A complete trade cessation would deliver an immediate shock to this export-driven sector, leading to an abrupt contraction in output and industrial activity.

On the US side, exports to China account for a far smaller slice of GDP—around 0.5% to 0.7%. This asymmetry suggests that while the US would experience some loss in output, the direct GDP contraction would be more contained. However, this narrow view ignores the broader, more insidious impact of inflation. As a consumer-driven economy heavily reliant on low-cost imports from China, the US would face acute supply-side inflation. Prices for consumer electronics, apparel, home goods, and countless essentials would spike, eroding purchasing power and potentially triggering a period of stagflation—a scenario where inflation rises even as economic growth stagnates.

Historical data from the 2018–2020 US-China trade war revealed that tariffs alone increased inflation by up to 1%, and that was with trade still ongoing. In a scenario of total decoupling, the US could see inflation surge several percentage points higher, prompting aggressive monetary tightening that could worsen a recession.

China, meanwhile, would likely encounter both demand-side and cost-push inflation dynamics. On one hand, the loss of a major export market could lead to deflationary pressures in certain sectors due to oversupply. On the other hand, replacing US-sourced components and commodities with costlier alternatives from other countries could raise input costs for manufacturers, introducing a more complex inflation-deflation dichotomy.

China would experience a sharper contraction in output and GDP, while the US would grapple with intense consumer inflation and a rise in living costs.

2. Corporate Operations: Sector-Specific Consequences

The halt of trade between the world’s two largest economies would hit corporations with devastating force—particularly those with cross-border dependencies in supply chains, production, or sales.

Technology and Electronics

Apple assembles over 95% of its products in China, with Foxconn and other suppliers deeply embedded in the Chinese manufacturing ecosystem. A trade halt would immediately disrupt Apple’s supply chain, causing delays, shortages, and financial losses. Other American tech companies—like Intel, Nvidia, AMD, and Qualcomm—would suffer both upstream and downstream: they would lose access to China’s consumer base and face manufacturing delays for components assembled or tested in China.

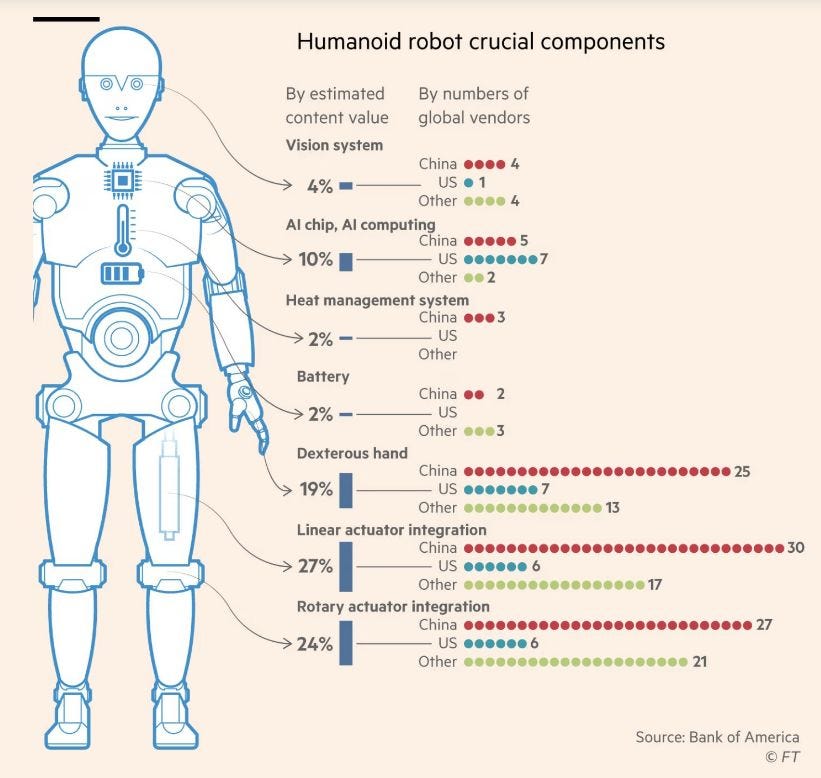

Conversely, Chinese tech companies like Huawei, Xiaomi, and SMIC remain reliant on US-made semiconductors, design software (EDA tools), and advanced chip manufacturing equipment. Though China has accelerated efforts to localize these inputs, full self-reliance remains years away. A sudden halt would freeze operations for many companies reliant on American intellectual property or capital goods.

Can SMIC Overcome Its Bottleneck Solely Through DUV Immersion? SMIC vs TSMC?

Manufacturing and Industrial Equipment

The manufacturing sector would suffer massive collateral damage. US industrial firms rely on Chinese parts for everything from heavy machinery to medical devices. A disruption would bring assembly lines to a halt, delay shipments, and increase costs as companies scramble to find new suppliers.

In China, sectors like electronics, home appliances, textiles, and toys are deeply embedded in the global supply chain with the US as their largest customer. Losing that demand would cause factory closures, layoffs, and inventory pile-ups. Entire industrial towns—such as Dongguan or Ningbo—could see their local economies collapse.

With China supplying 85% of all toys sold in the U.S. and with no alternative manufacturing capacity readily available elsewhere, tariffs on toys will cause substantial harm to consumers due to higher prices and fewer choices.

Agriculture and Food Security

The US is a key supplier of soybeans, corn, pork, and dairy products to China. In 2023 alone, US farmers exported billions worth of agricultural goods to China. A full stop in exports would devastate American agricultural states like Iowa, Nebraska, and Illinois. China's alternatives, such as Brazil and Argentina, may not be able to match US volume and delivery schedules in the short term, causing price fluctuations and food security concerns.

Aerospace and Transportation

Boeing would lose one of its largest foreign customers—Chinese airlines—and its commercial jet backlog would shrink dramatically. Conversely, China’s aerospace industry, particularly its domestically-developed C919 jet, still depends on US-made engines and avionics. These projects would be delayed significantly, and reliance on European suppliers would increase.

Energy and Resources

The US currently exports crude oil, natural gas, and various raw materials to China. These shipments would need to be redirected to other markets, likely at lower prices, reducing revenue for American energy producers. China would have to secure alternative sources from Russia, the Middle East, or Southeast Asia, possibly at a higher cost or political risk.

Energy Exports:

Liquefied Natural Gas (LNG): In 2021, China became the second-largest destination for U.S. LNG exports, receiving approximately 1.2 billion cubic feet per day, accounting for 12.7% of total U.S. LNG exports.

Crude Oil: In 2024, U.S. exports of oil, gas, and coal to China were valued at $14.7 billion, highlighting China's role as a major importer of U.S. energy commodities.

Raw Material Exports:

Wood Products: The U.S. has been a significant supplier of hardwood logs, lumber, and veneers to China. In 2007, these exports totaled $442 million, representing 77% of total U.S. wood exports to China.

Metals: While specific recent figures for metal exports are not provided in the available sources, China has been a key market for various U.S. raw materials, including metals, over the years.

In summary, the impact across industries is a case of relative gains and losses. U.S. multinational corporations would lose both the support of China’s manufacturing base and access to the Chinese consumer market, while Chinese export-driven companies would lose one of their most important buyers. From the perspective of corporate revenue, Chinese companies that rely on exports to the U.S.—such as contract manufacturers and processing trade firms—would face a precipitous drop in income. On the other hand, U.S. companies targeting the Chinese market—particularly in sectors such as agriculture, aviation, and high technology—would also suffer the loss of major orders.

In addition, a large number of U.S. companies that are heavily dependent on China’s industrial supply chains could face production shutdowns or disruption of product lines. It is fair to say that enterprises in both countries would experience major shocks. However, in terms of scale and reach, the impact would differ. In China, the primary victims would be export-oriented manufacturing firms, especially a vast number of small and medium-sized enterprises whose survival could be at risk. In the U.S., the primary impact would be felt by large multinational corporations with business ties to China, along with a wide network of downstream agents and retailers who would face significant operational difficulties.

Geographically, the scope of the impact also varies between the two countries. In China, the disruption would be concentrated in coastal regions with outward-facing economies and established industrial clusters. In the U.S., the shock would ripple across the agricultural heartland, high-tech sectors, and consumer markets.