The Ever-Shifting Relationship Between TSMC and Intel: A History of Competition and Cooperation

From Rivalry to Strategic Partnerships and Back Again—The Battle for Semiconductor Dominance

2025/03/03

Broadcom, Nvidia, and Intel Collaboration Announced – Insights from SemiVision on Intel 18A

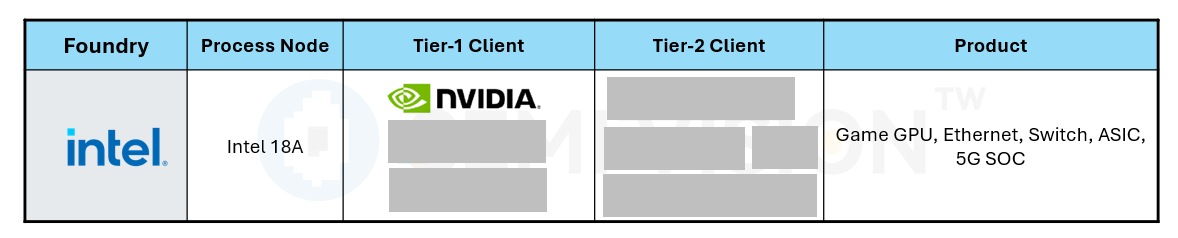

Today, news broke about a collaboration between Broadcom, Nvidia, and Intel. The SemiVision team has an in-depth understanding of Intel’s 18A process and has learned that Intel currently has Tier 1 and Tier 2 customers, many of whom are CSPs. Notably, Broadcom is a Tier 2 customer.

Broadcom’s partnership with Intel is primarily driven by OpenAI’s Stargate project. At the same time, OpenAI is also actively collaborating with TSMC on the A16 node. Broadcom’s key ASIC customers include Google and OpenAI.

Given that Microsoft is Intel’s largest CPU customer, a partnership between Intel and Microsoft is both logical and expected. Meanwhile, the collaboration between Intel and Nvidia aligns with the “Made in America” initiative. The SemiVision team has conducted an in-depth analysis of the details of this collaboration. For more information, please read our article.

The semiconductor industry is the cornerstone of global technological advancement, and two of its major players—Taiwan Semiconductor Manufacturing Company (TSMC) and Intel—have experienced a complex and evolving relationship over the decades, oscillating between competition, rivalry, and collaboration.

TSMC and Intel operate under distinct business models. TSMC specializes in pure-play foundry services, focusing solely on semiconductor manufacturing for various clients, whereas Intel has long adhered to the IDM (Integrated Device Manufacturer) model, designing and manufacturing its own chips. However, as market demands shift and technological advancements progress, their relationship has undergone numerous transformations—from fierce competitors to strategic partners, and now, possibly, heading toward another period of divergence.

I. From Competition to Collaboration: The Complex History of TSMC and Intel

1. The Era of Competition: Intel’s IDM Model vs. TSMC’s Pure-Play Foundry Approach

For decades, Intel relied on its own wafer fabrication plants to manufacture chips, maintaining full control over both design and production without outsourcing. In contrast, TSMC rose to prominence with its pure-play foundry model, offering manufacturing services to a wide range of semiconductor design companies, including AMD, NVIDIA, Apple, Qualcomm….etc.

During the 2000s, Intel remained the dominant force in the global semiconductor industry, leading the x86 processor market and maintaining a long-standing edge in process technology. However, after 2010, as process node scaling became increasingly challenging, TSMC steadily closed the gap and eventually surpassed Intel in advanced nodes, particularly at 7nm, 5nm, and even 3nm. This shift led to Intel losing its technological and market dominance, prompting the company to rethink its strategy and seek transformation.

2. Transformation and Collaboration: Intel Outsources Manufacturing to TSMC

In 2021, Intel announced that it would outsource part of its production to TSMC, marking a significant shift in Intel’s manufacturing strategy. At the time, Intel was struggling with delays in its 10nm and 7nm process development, while AMD, leveraging TSMC’s 7nm technology, was rapidly gaining market share. To counter this competitive pressure, Intel adopted a dual-track strategy—continuing to improve its in-house process technology while also utilizing TSMC’s advanced manufacturing capabilities to remain competitive.

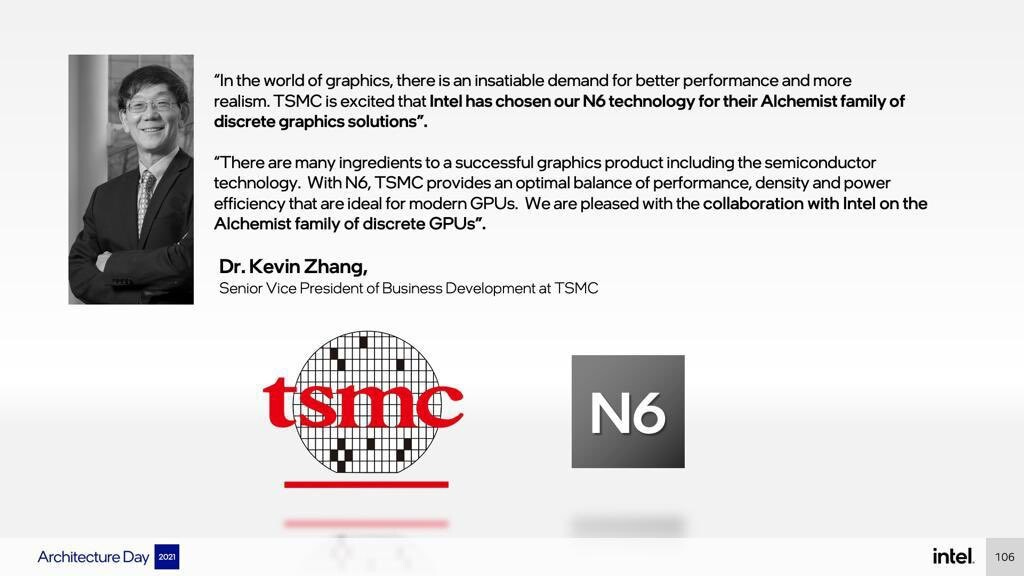

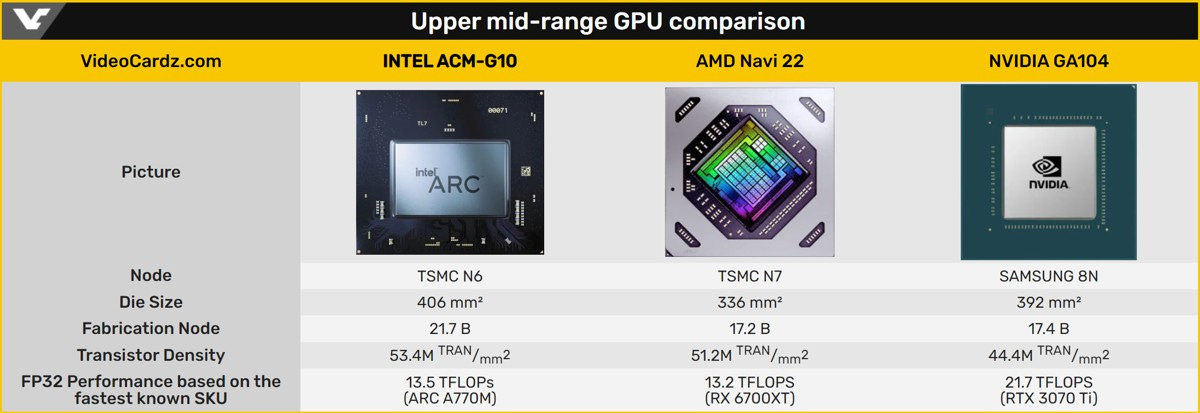

As part of this strategy, Intel outsourced the production of its GPU products (such as Arc discrete graphics cards) and certain CPU models to TSMC, utilizing its 6nm and 5nm process nodes. Additionally, Intel began discussions with TSMC about potential collaboration on more advanced nodes, including 3nm technology, signaling a deeper reliance on the foundry model for specific product lines.

II. Renewed Competition: Intel’s Foundry Ambitions and TSMC’s Challenges

1. Intel Revives Its IDM 2.0 Strategy, Entering the Foundry Business

In 2021, Intel CEO Pat Gelsinger announced the "IDM 2.0" strategy, marking a significant shift in Intel’s approach. In addition to continuing in-house chip production, Intel launched Intel Foundry Services (IFS) to aggressively expand its foundry business—directly competing with TSMC.

Intel set an ambitious goal: to become the world’s second-largest foundry by 2030, trailing only TSMC. The company also aimed to attract major AI and high-performance computing (HPC) customers, such as NVIDIA, AMD, and Microsoft.

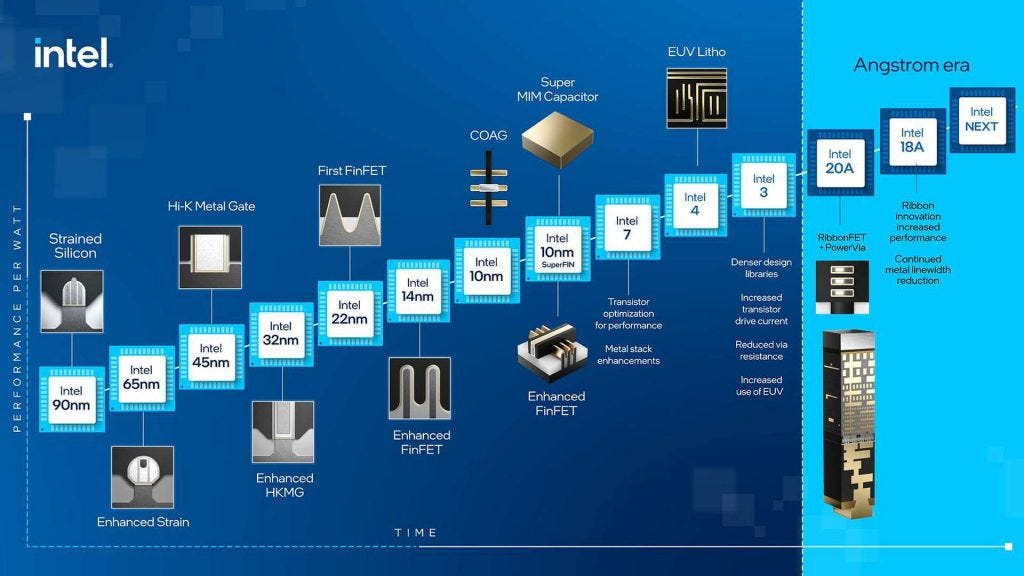

To accelerate its technological progress, Intel invested heavily in new wafer fabrication facilities and process advancements, including:

Building new fabs in Arizona and Ohio, USA.

Partnering with the U.S. government to secure funding through the CHIPS Act, supporting domestic semiconductor manufacturing.

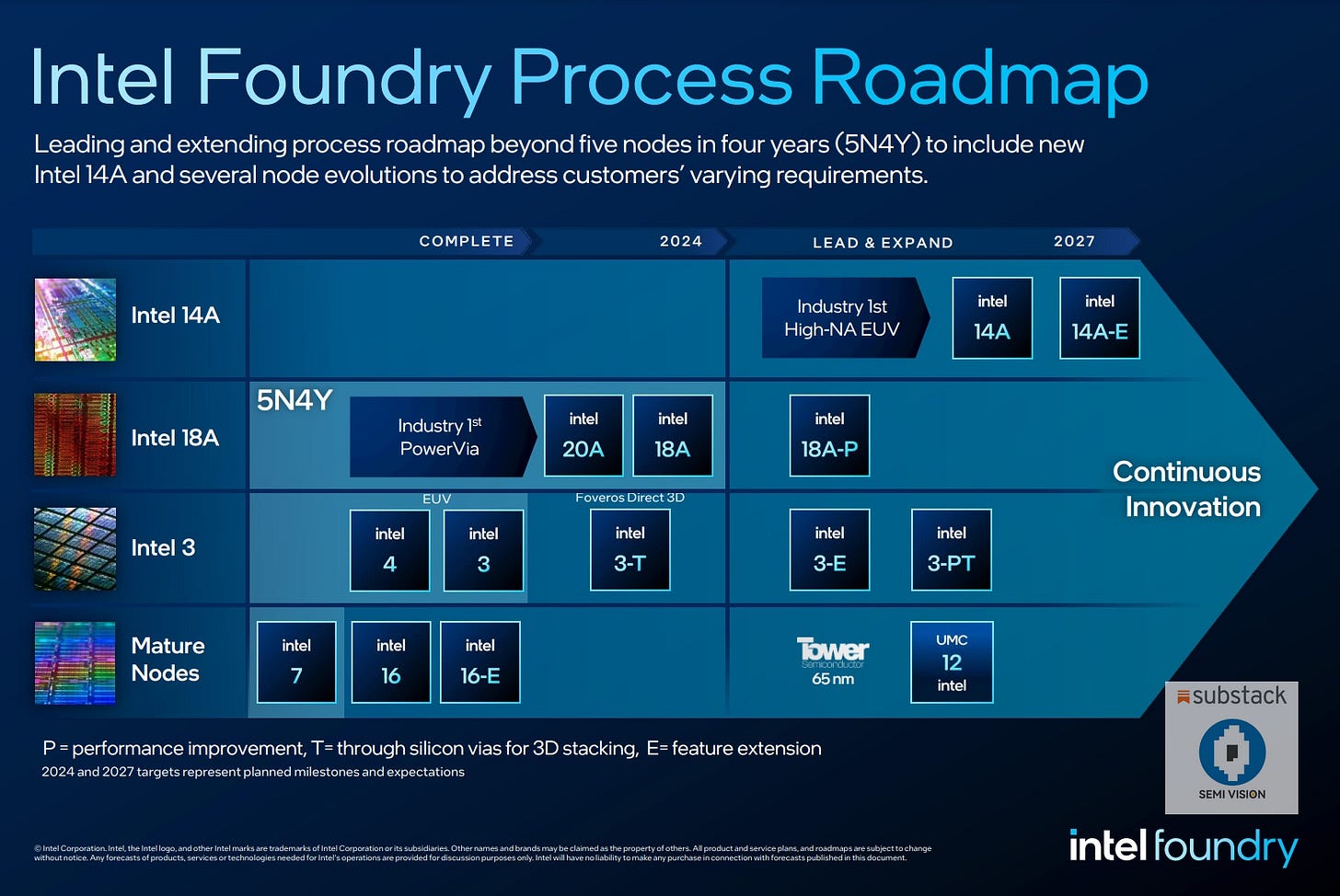

Developing advanced process nodes, including Intel 18A, Intel 3, and Intel 14A, with the goal of matching or surpassing TSMC’s 2nm technology by 2025-2026.

This shift transforms Intel from being just a TSMC customer to a direct competitor, bringing their relationship back into a phase of intense rivalry.

2. TSMC’s Strengths and Challenges

Despite Intel’s aggressive push into the foundry business, TSMC remains the global leader in advanced process technology. However, the company faces several key challenges:

Intensifying Market Competition: Intel is investing heavily in its foundry business, while Samsung is also aggressively challenging TSMC, particularly in the 3nm and 2nm process nodes, competing for market share.

Geopolitical Risks: Since TSMC’s primary manufacturing facilities are located in Taiwan, governments in the U.S. and Europe are concerned about supply chain vulnerabilities. As a result, they are urging TSMC to build new fabs overseas, such as in Arizona, USA, which could lead to higher production costs. (TSMC Arizona)

Diverse Customer Demands: Major clients such as Apple, NVIDIA, and AMD have increasingly stringent requirements for TSMC’s process technology. To retain these high-value customers, TSMC must maintain its technological leadership or risk losing key clients.

Despite these challenges, TSMC continues to dominate the global semiconductor market and is heavily investing in 2nm and 1.4nm process technologies to ensure its future competitiveness.

III. Future Outlook: Coexistence of Competition and Collaboration?

Although Intel and TSMC have once again entered a phase of direct competition, there remains potential for collaboration in certain areas. For example, advanced packaging technologies, contract manufacturing for specific products (such as AI chips), and supply chain diversification may lead Intel to continue relying on TSMC’s capacity in select scenarios.

Moreover, with the explosive growth of AI and high-performance computing (HPC), the global demand for chips is expected to continue rising. The future semiconductor market may not be dominated by a single company, but rather a system of shared responsibilities and cooperation among multiple players. TSMC and Intel may remain rivals in some areas while collaborating in others, depending on market needs and technological advancements.

In summary, the dynamic relationship between TSMC and Intel reflects the fierce competition and rapid evolution of the semiconductor industry. In the coming years, both companies will compete in technology, production capacity, and market positioning. Ultimately, the winner will be determined by who can overcome technological bottlenecks, meet market demands, and maintain a stable supply chain. In this semiconductor race, there are no permanent enemies—only ever-changing strategies and collaboration models.

Intel Foundry: Intel’s System Foundry Business for External Clients

Intel Foundry is Intel’s dedicated semiconductor foundry division, focused on manufacturing chips for external customers. It is positioned as the world’s first system foundry designed for the AI era and has already secured design orders across multiple process nodes, including Intel 18A, Intel 16, and Intel 3. Additionally, Intel Foundry has a strong presence in advanced packaging technologies (ASAT), supporting 2D, 2.5D, and 3D packaging solutions.

Key Aspects of Intel Foundry

Business Model:

Intel Foundry operates as an independent business unit with its own board of directors and may seek external funding in the future.Manufacturing Capabilities:

The foundry provides a comprehensive, optimized ecosystem, covering:Silicon verification IP suites, accelerators, and chiplet standards

Advanced packaging technologies, including FCBGA/LGA, EMIB, and Foveros

Cutting-edge photomask fabrication equipment to support next-generation lithography technology

Process Roadmap:

In addition to its current process nodes, Intel Foundry is planning to develop Intel 14A, aimed at addressing diverse customer demands.Key Partnerships:

Intel Foundry has collaborations with major industry players:Microsoft has selected Intel 18A for manufacturing its custom chip designs.

Intel and Arm are working together to provide advanced foundry services for Arm-based SoCs (System-on-Chip).

Financial Performance:

Over the past two years, Intel has invested approximately $25 billion into its foundry business. The estimated lifetime transaction value of Intel Foundry exceeds $15 billion. However, the division remains unprofitable.In April 2024, Intel reported an operating loss of $7 billion from its foundry business, with total revenue of $19 billion, reflecting a 31% year-over-year decline.

Intel Foundry’s Strategic Transition in 2025

As of February 2025, Intel’s foundry business is undergoing a critical transformation. Recent market rumors suggest that Intel may spin off its foundry business and form a joint venture with TSMC to co-operate wafer fabs, aiming to accelerate the development and mass production of advanced process nodes.

Meanwhile, Intel is making progress on Fab 52, its new wafer facility in Arizona, USA, which is currently installing production equipment to support Intel 18A manufacturing, with mass production expected in 2025.

Challenges Ahead

Despite Intel’s aggressive push into the foundry market, it still faces significant challenges, including:

Lagging behind competitors in process technology, particularly compared to TSMC and Samsung.

A lack of major foundry customers, putting pressure on its cash flow and business execution.

Looking Forward

Despite these obstacles, Intel remains committed to expanding its foundry business. The company has scheduled its annual event in April 2025, where it plans to unveil its latest strategic developments and technological advancements in the foundry sector.

Related New: 2025/03/03 Exclusive: Nvidia and Broadcom testing chips on Intel manufacturing process, sources say

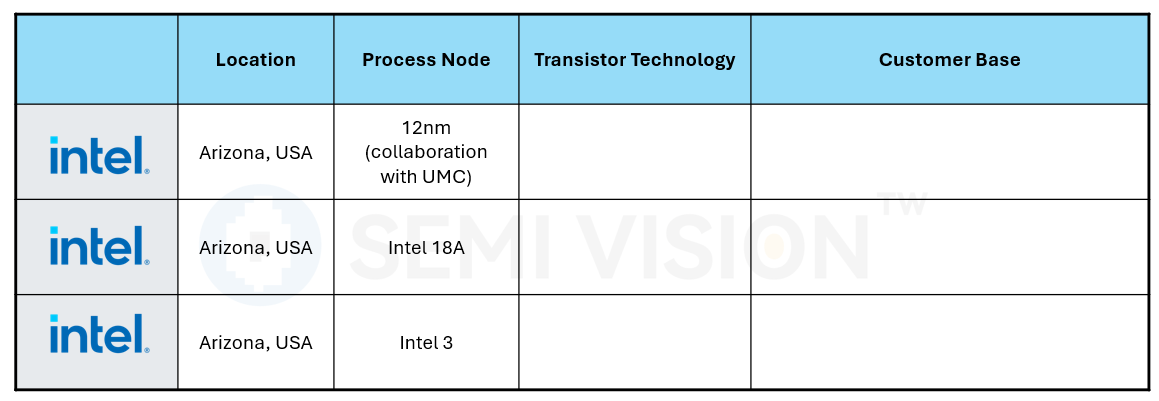

If you would like to learn more about the tables in our Substack articles, feel free to reach out—we’d be happy to discuss the details with you. Currently, SemiVision offers report services, and all articles on our Substack are related to these reports. If you’re interested in understanding the report content, we’re open to further discussion.

The SemiVision team has an in-depth understanding of advanced packaging and provides unique insights into material and equipment suppliers. The tables are part of SemiVision’s advanced packaging report, specifically two tables from the report. For detailed information, please refer to our reports and Substack articles

Paid Subscribers Area:

Intel 18A Process Overview