How to Understand the Semiconductor Industry in 1 Day

Original Article by SemiVision

How to Understand the Semiconductor Industry in 1 Day

If you’ve been following the semiconductor industry for years, yet still feel a lingering unease— “I feel like I understand it… but I can’t quite say how well, or at what level”— you’re not alone.

In fact, most people approach “learning semiconductors” the wrong way from the very beginning.

They start with terminology:

5nm, CMOS, EUV, CoWoS, HBM, TIM, MCL, advanced packaging, silicon photonics, chiplets. The information density is high, but real understanding never accumulates at the same pace.

The result is paradoxical:

the more news you read, the less confident your judgments become.

The problem is not intelligence, nor effort.

It is this:

Most people never build a structure for thinking about semiconductors.

This article is SemiVision’s one-day understanding protocol—designed specifically for industry readers.

Its goal is not to turn you into an engineer, but to help you:

See the semiconductor industry clearly, for the first time, from a true industry-level perspective.

This is a long-form piece meant to be revisited.

Not something you read once and forget.

I | You Don’t Fail to Understand Semiconductors Because You Lack Expertise

You Fail Because You’re Standing in the Wrong Place

Hidden beneath most attempts to learn semiconductors is an unspoken question:

From where do I need to look at this industry to truly understand it

Engineers, investors, material suppliers, equipment vendors, system companies—

each occupies a completely different industrial reality.

Those who genuinely understand semiconductors don’t do so because they “know more facts,” but because they live within a specific structural position.

A process engineer doesn’t ask why 2nm matters—it is a daily constraint.

A packaging materials supplier discussing CoWoS isn’t following a trend—they’re managing yield and capacity stress.

A system OEM talking about HBM isn’t chasing performance—it’s managing supply-chain risk.

Semiconductors feel complex not because they are inherently opaque,

but because you have not yet entered a position where these questions arise naturally.

The first step in understanding any industry is not learning knowledge—it is choosing the right vantage point.

II | You Don’t Learn Because, Deep Down, You Don’t Yet Need To

All learning is inherently goal-driven.

Your brain never learns “everything.”

It learns only what it believes is necessary to achieve a specific outcome.

If semiconductors exist in your life merely as a conversation topic,

a résumé keyword, or background context for following tech news,

your cognition will automatically default to the lowest-cost learning strategy:

surface familiarity.

You memorize a few terms.

You recognize headlines.

You know just enough to nod along.

That is not a failure of intelligence.

It is optimal behavior for a low-stakes goal.

But the moment semiconductors become something you must reason with,

everything changes.

The moment you are forced to use them to make judgments—such as:

Evaluating a company’s long-term competitive position

Understanding why a once-promising technical roadmap was quietly abandoned

Assessing whether supply-chain or capacity risk is being structurally underestimated

your cognitive mode shifts immediately.

At that point, memorization is no longer sufficient.

Because memorization cannot support decisions.

Semiconductors stop being “information”

and become a decision framework.

You no longer ask:

What does this term mean?

You start asking:

Why did this constraint emerge here?

What trade-off is being made, and by whom?

Which limitation is fundamental, and which is temporary?

This is the dividing line between knowing about the industry

and thinking within the industry.

And this is precisely why SemiVision does not optimize for information volume.

More data does not produce clarity.

More news does not produce understanding.

More terminology does not produce judgment.

SemiVision optimizes for one thing only:

Can you use semiconductors to explain why events unfold the way they do?

Why progress accelerates here but stalls there.

Why capital floods one segment while quietly exiting another.

Why some risks are loudly discussed while others remain invisible—until they are unavoidable.

When you reach that point, learning no longer feels forced.

Because you are no longer studying semiconductors.

You are using them.

III | You Resist Truly Understanding—Because Once You Do, You Can’t Look Away

There is a harsh reality about the semiconductor industry:

Once you understand its structure, you can no longer pretend the problems aren’t there.

You begin to see that:

Some narratives exist primarily to satisfy capital markets

Some technology paths were physically doomed from the start

Some supply-chain risks are not hypothetical—it’s only a matter of time

This forces you to revise earlier beliefs,

and sometimes to admit that past convictions were simply wrong.

For many, this discomfort outweighs the desire to understand.

Yet all real industry insight begins exactly here.

IV | Semiconductors Exist at a Systems Level

Semiconductors are not linear knowledge.

They are the interaction of multiple stacked systems:

Physical limits (materials, electrical behavior, thermal constraints)

Engineering execution (processes, yield, equipment)

System design (packaging, interconnects, cooling)

Industrial structure (supply chains, capital expenditure)

Geopolitics (subsidies, export controls, national strategy)

If you remain trapped in any single layer,

everything appears chaotic.

The real inflection point is understanding this:

The semiconductor industry does not compete on technology—it competes on who manages constraints best.

Power, physics, capacity, capital, and politics.

At that moment, many headlines suddenly make sense.

V | SemiVision’s Standard of Understanding: Can You Anticipate the Next Bottleneck?

At the industry level, understanding is not recall. It is not the ability to repeat terminology, summarize news, or remember timelines.

Understanding is foresight.

It is the ability to see why the industry is constrained where it is today—

not at the surface narrative level, but at the level of physical limits, capital allocation, organizational inertia, and system design trade-offs.

It means being able to explain why progress appears to slow at certain moments,

why entire roadmaps bend or collapse, and why some “breakthroughs” arrive years later than promised—if they arrive at all.

The real test of understanding is not whether you know what is happening.

It is whether you can answer questions like:

Can you explain why the industry is stuck here today,

and why the constraint could not be bypassed by effort, money, or optimism?

Can you reason where the bottleneck will migrate next once this constraint is partially relieved—

from process to packaging,

from compute to memory,

from silicon to power,

from engineering to geopolitics?

Can you identify who will feel pressure first when that shift occurs—

which companies, which suppliers, which parts of the supply chain will start to crak before the rest of the market realizes anything has changed?

This is not intuition. And it is not prediction in the speculative sense.

It is systems feedback thinking—

what cybernetics describes as the basic loop underlying all complex systems:

Goal → Action → Feedback → Adjustment

The semiconductor industry does not move in straight lines. It iterates.

A goal is set: higher performance, lower power, lower cost.

Actions follow: new nodes, new materials, new architectures.

Feedback emerges: yield loss, thermal walls, capital intensity, supply chain fragility.

And the system adjusts—often in ways that invalidate prior assumptions.

Those who truly understand the industry are not reacting to headlines.

They are watching the feedback.

They recognize that every “solution” creates a new constraint,

and every removed bottleneck simply forces the system to reveal the next one.

Once you adopt this lens, something fundamental changes.

You stop consuming information passively.

You stop asking, “What happened?”

Instead, you ask:

What constraint is being exposed right now?

What behavior will this feedback force next?

Who is structurally unprepared for that shift?

At that point, you are no longer a reader of the industry.

You become an analyst within it.

VI | The SemiVision One-Day Understanding Protocol

Morning | Constructing an Anti-Vision

If you still don’t understand semiconductors five years from now, where are you in the industry?

Which three terms do you hear constantly but cannot clearly explain?

Which part of the supply chain have you been consciously avoiding?

Daytime | Interrupting Automatic Interpretation

Repeatedly ask:

What constraint is this news actually addressing?

Is this a short-term supply issue or a structural limitation?

Is this company constrained by technology, capacity, or system integration?

Evening | Compressing Insight

Write one sentence each:

The semiconductor industry is fundamentally competing over ________.

From what position am I currently observing it?

VII | Turn Understanding Semiconductors into a Long-Term Game

When you complete this day, something fundamental shifts.

You no longer need willpower to “keep learning.”

You no longer chase information out of anxiety or fear of missing out.

Because you’ve crossed a boundary.

You’ve entered the system.

From this point forward, learning stops being an obligation and becomes a by-product of positioning.

You are no longer collecting facts—you are observing dynamics.

Your anti-vision defines what you refuse to lose.

It is the cost of ignorance made visible.

The future you will not allow yourself to drift into.

Your framework defines how you win.

Not by predicting headlines, but by understanding constraints, feedback loops, and pressure points.

Not by knowing more, but by seeing earlier.

Every news item becomes a side quest.

Not noise—context.

Not distraction—signal, once you know where to look.

Every technical bottleneck becomes a boss fight.

Power density.

Yield.

CapEx.

Materials.

Geopolitics.

Each one revealing who is prepared, who is exposed, and who will be forced to adapt next.

This is the purpose of SemiVision.

Not to tell you what happened.

Not to summarize press releases.

Not to flood you with terminology.

But to place you inside the structure—

where events explain themselves,

where complexity resolves into causality,

and where the industry becomes intelligible, not overwhelming.

Once you stand there, you don’t need motivation. You only need to pay attention.

1-day Reading Plan Tailored for Readers

SemiVision based on the types of content the Substack publishes and typical deep dives it offers. Links go directly to representative SemiVision posts where available — and are grouped by theme so you progressively build understanding.

Morning — Core Industry Landscape

1. Semiconductor Fundamentals & Macro Trends

Start with a broad overview of industry dynamics — drivers like AI demand and packaging shifts. AI is driving global semiconductor demand and ecosystem evolution

2. Taiwan’s Strategic Role & Ecosystem Shifts

This piece shows how Taiwan’s strategy is evolving beyond wafer fabs to packaging and materials.

Midday — Technology Deep Dives

3. Advanced Packaging & 3D Integration

Specialized topics such as hybrid bonding, CoPoS, and heterogeneous integration are central to how AI era chips are built.

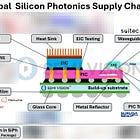

4. Materials & Supply Chain Bottlenecks

After technology, read about materials self-sufficiency and supply chain risks — core to where the industry bottleneck lies.

Afternoon — Competitive Intelligence & Strategic Analysis

5. Competitive Positioning and Industrial Focus

Explore why front-end fabs alone no longer define competitive dominance, and why heterogeneous integration matters.

6. System-Level Co-Design

Read about how semiconductors are evolving into system-level integration platforms — from transistors to optics and cooling.

Evening — Synthesis & Reflection

7. Summarize What You’ve Learned

Write down:

Three key industry constraints today (e.g., capacity, materials, thermal limits)

One insight about where the next bottleneck will likely emerge

How Taiwan’s ecosystem strategy fits into global competition

8. Discussion & Forward Questions

Use your notes to ask:

How does 3D packaging redefine performance value?

Which supply chain nodes are most strategically vulnerable?

What’s the most surprising thing you learned today?

Optional Further Reading (Premium / In-Depth)

If you subscribe to SemiVision, other paid posts often cover:

Materials self-sufficiency and localization

Supply chain evolution for advanced packaging & photonics

Optical interconnects and heterogeneous integration strategy

When you finish this day, something subtle but irreversible happens.

You stop trying to keep up with the semiconductor industry.

And start seeing it move.

Learning no longer feels like effort, because you are no longer collecting facts—you are operating inside a system.

You recognize constraints before headlines explain them.

You sense pressure building before earnings reflect it.

You understand why certain paths were inevitable long before they appear “obvious” in hindsight.

From this point forward, every article is no longer noise.

It is signal—filtered through a framework you now possess.

Every bottleneck becomes a clue.

Every roadmap shift becomes a consequence.

Every supply-chain shock becomes traceable, not surprising.

You don’t need to force yourself to learn anymore.

Because you’ve entered the system—and once you’re inside, the industry starts teaching you.